Rent or buy a home?

(from Asheville Metro Economy E-newsletter - January

2005)

Here is a simple calculation to illustrate that buying a home is generally a lot better than renting one, the reason that almost every American buys a home as soon as he or she can afford to buy one. Suppose you rent a house at $1000/month and you pay $12,000/yr rent. As the housing price appreciates an average of ~7% per year (a typical long-term average) and your landlord increases your rent 5% per year, your total rent payment will be $12,600, $13,230, $13,891, $14,586 for the second, third, fourth, and fifth year, respectively, and your total rent payment for five years will be $66,308. If you buy the same house at a price of $160,000 (house price may be roughly estimated as 160 times monthly rent) with a 100% mortgage loan at 6% 30-year fixed interest rate, your mortgage interest, tax, insurance, and home maintenance costs will be about $12,000 per year. Since your interest rate is fixed, your total yearly payment increases only slightly and your total payment for five years will be about $70,000. Your mortgage interest and tax payments are tax-deductible and will save you ~$10,000 taxes in five years depending on your tax brackets. Your house value will increase $60,000 in just 5 years assuming an average yearly appreciation rate of 7%. This will save/earn ~$70,000 in 5 years by buying rather than renting a home. That is an average savings/earnings of ~$1160 every month. Detailed calculations of various situations can be done at:

http://realestate.yahoo.com/re/calculators/rent.html

Furthermore, owning a home will bring great pride and satisfaction of homeownership and

freedom, allowing you to add, modify, or build onto the property as you wish. You

will quickly build up home equity and wealth. It will greatly enhance your credit scores,

which will lower your automobile and health insurance premiums, lower the costs of any

loans you borrow (see www.myfico.com), and bring new opportunities for buying more

properties and other businesses in the future.

See

an article on how real estate savvy people do not need to pay any tax using all the

tax breaks for real estate investment.

Why wait? If you can afford to pay a monthly rent of $700 to $1000, you can generally

afford to buy a $140,000 to $200,000 home, even with very little down payment.

Rent to own: If you really cannot

qualify now for a loan, you may want to rent a property with the option to buy it in one

or a few years. Here is an example of how it works: for a house that normally rents for

$700/month, its current fair market price is roughly 160 times the rent, that is,

$110,000, and the landlord is likely to agree to lease it to you with the option to buy it

within 2 years at a fixed price of $120,000. You put down a rent security deposit as you

normally would for any rental (~one month rent), plus a non-refundable purchase option fee

(~another month rent). Your rent will be $800/month, of which $100/month will be credited

to your down payment for purchase of the property. The great advantage to you is that you

have fixed the purchase price at $120,000 (5% price increase per year over the current

fair market price) even if the market price actually goes up 7% (long term average) or

15% or more per year. You can be sure you will realize the American dream, but you

do not have to buy the property if its market price actually decreases in two years (highly

unlikely) or for any other reasons. The landlord also benefits as he or she can receive a

higher monthly rent, have a tenant who is likely to take better care of the property, and

can sell the property directly to the tenant with ease. If you are interested in this kind

of win-win deal, please let us find you one at no cost to you.

Buying

a house as a rental investment

(30-40% annual return)

| Rental

House Investment Return Worksheet: |

|

| Purchase price |

200000 |

| Down payment(20%) |

40000 |

| 6%-30yr Mortgage payment/yr |

11508 |

| Property tax (1.1%) |

2200 |

| Home Insurance |

340 |

| Repair/mantainance reserve |

1000 |

| Professional property management (10% rent income) |

1425 |

| Total expense/yr |

16473 |

|

|

| Rental income/yr (~7.5% of house price, 6% vacancy) |

14250 |

| Property depreciation tax saving |

2000 |

| Property-tax tax-deductable saving |

660 |

| Repair+ other expenses tax saving |

600 |

| Total mortgage principal paydown (1st yr) |

1908 |

| House appreciation (6% per year) amount |

12000 |

| Total income (rent+tax savings+appreciation) |

31418 |

|

|

| Net income/yr (income - expense) |

14945 |

| Investment return (% per year) |

37 |

Use this Excel file to

calculate investment return based on different assumptions (e.g., different price,

interest, rent, etc.)

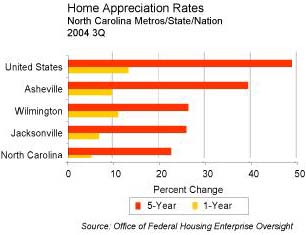

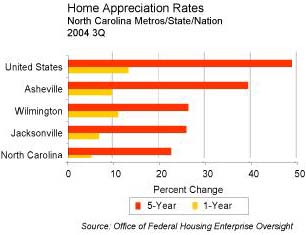

(from Asheville

Chamber of Commerce)

Rental investment return is far better than the 3-5% annual return by investing in bank

CD's or even the 8% theoretical average long-term annual return in a diverse stock

portfolio. Rental investment return is even better since you only pay some tax for the house

price increase when you sell the property, whereas other investment incomes or your

regular job income are taxable in the same year (after federal and state income taxes,

Medicare, social security and other taxes, you only keep about half what you earn).

|

|